REcurring Income Token (REIT) is a Decentralized Income Generation Protocol on Binance Network.

In general, REIT Token incentivizes participation, facilitates governance, and catalyzes user contribution. Users earn REITg governance token through pool participation and participate in protocols’ continuous improvement and governance.

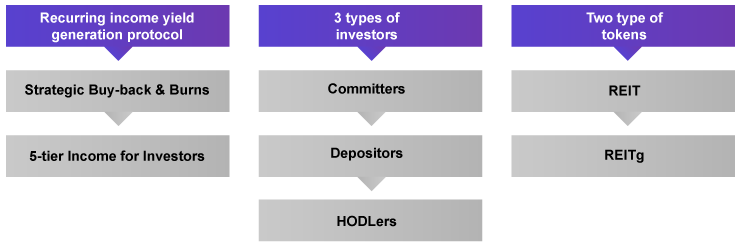

REIT protocol allows investors to commit or deposit their recurring incomes into the system and make the best profit out of them. REIT is a commitments and deposits based protocol which provides the best return by making use of the opportunities provided by DeFi protocols. The rewards collected in the system are distributed among the participants to generate additional revenue.

One main strategy of the protocol is to reduce the total coin supply in the system through systematic Buy Back & Burn transactions with a purpose of increasing the value of REIT token.

Including the Buy back and Burn strategy that will ensure the systematic valuation of REIT tokens, the REIT protocol applies a five-tier yield generation strategy using the rewarding mechanisms.

This will allow REIT token holders to yield a comparably higher APY (Annual Percentage Yield) and create an advantage effect compared to traditional finance (TradFi) and lending oriented decentralized financial investment (DeFi) instruments.

The REIT token is a decentralized, unbiased, collateral-backed cryptocurrency. REIT is held in cryptocurrency wallets or within platforms, and is supported currently only on Binance.

REITg is the governance token of the protocol. Investors all around the world, with the highest amount of REITg, manage the project, through a system of scientific governance and voting mechanisms. REITg holders manage the REIT Protocol and the financial risks of REIT to ensure its stability, transparency, and efficiency.